Historical market data demonstrates that buy-and-hold strategies consistently outperform market timing attempts, with buy-and-hold investors achieving superior returns ranging from 0.32% to 1.05% annually across major global markets. Analysis of S&P 500 performance reveals that a $10,000 initial investment grew to $64,844 through buy-and-hold approaches, while missing just the top 40 trading days through timing attempts resulted in significant losses, with portfolios declining to $8,048. Further examination of behavioral patterns and risk metrics illuminates the substantial advantages of maintaining consistent market exposure.

Key Takeaways

- Historical data shows buy-and-hold strategy outperforms market timing across all major markets, with performance gaps ranging from -0.32% to -1.05%.

- A $10,000 initial investment grew to $64,844 with buy-and-hold, delivering a 9.8% annualized return versus market timing’s lower returns.

- Missing just the top 10 trading days in the Dow Jones resulted in significant losses, highlighting the risks of market timing.

- Buy-and-hold strategies benefit from natural market recovery cycles and lower transaction costs compared to active timing approaches.

- Psychological factors and emotional biases often lead to poor timing decisions, while buy-and-hold removes emotional decision-making from investing.

Historical Performance Data: What the Numbers Tell Us

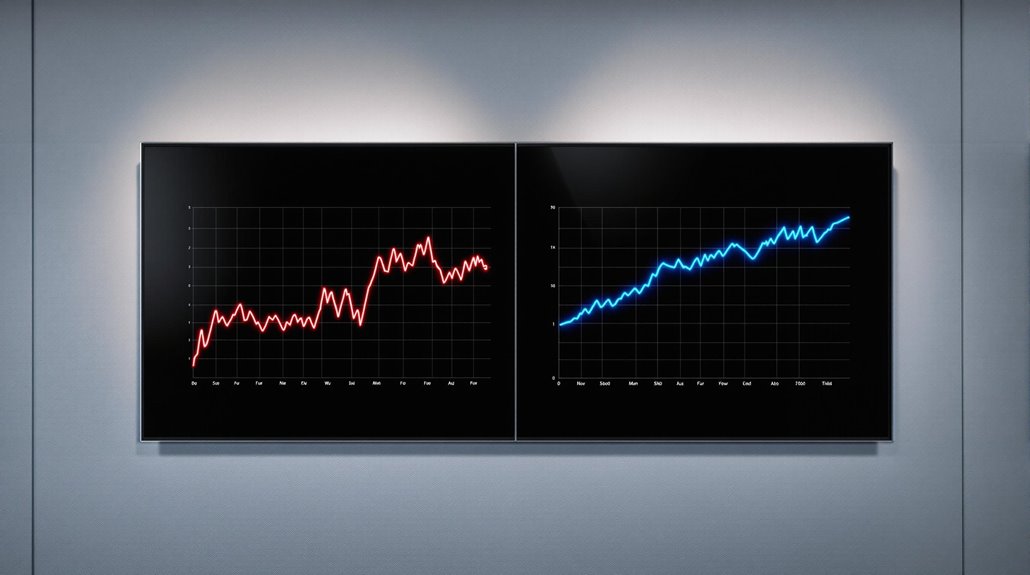

While market timing remains an alluring strategy for many investors seeking to maximize returns, extensive historical data from 2003-2022 presents compelling evidence in favor of maintaining consistent market exposure through buy-and-hold approaches.

The performance metrics demonstrate that an initial $10,000 investment grew to $64,844 with a buy-and-hold strategy, yielding a 9.8% annualized return. The average annual return of 9.10% for the S&P 500 further validates the effectiveness of this approach.

Analysis of historical trends reveals the severe impact of missing vital trading days. Investors who missed merely the top 10 performing days saw their returns diminish to $29,708, while those missing the top 20 days achieved only $17,826.

The data becomes more striking across investment cycles, as missing the top 30 days resulted in a mere $11,701 return, and missing the top 40 days actually led to a loss, with the portfolio declining to $8,048.

These statistics underscore the inherent risk of attempting to time market entry and exit points. Even legendary investor Peter Lynch advocated strongly against market timing strategies during his tenure at Fidelity, emphasizing the superiority of patient, long-term investing approaches.

The Psychology Behind Investment Decision-Making

Beyond the historical performance metrics, understanding the psychological factors that drive investment decisions illuminates why many investors struggle to maintain disciplined buy-and-hold strategies despite their proven effectiveness.

Behavioral finance research reveals how cognitive biases and emotional triggers systematically influence market sentiment and risk perception. Non-probability sampling studies show that digital investment environments significantly impact psychological decision-making patterns. The combination of herding behavior and overconfidence bias frequently leads investors to abandon long-term strategies in favor of market timing attempts, particularly during periods of heightened volatility.

Loss aversion and decision fatigue create significant psychological barriers to maintaining disciplined investment approaches. Contrarian trading opportunities often emerge when these psychological barriers cause widespread market overreaction.

Studies in investor psychology demonstrate that the fear of missing out (FOMO), amplified by social media platforms, often prompts impulsive trading decisions that deviate from established investment plans.

These behavioral patterns, coupled with information bias and social influence, explain why many investors underperform market indices despite having access to sophisticated analytical tools and historical data supporting buy-and-hold strategies.

Risk Assessment and Portfolio Impact

Empirical analysis of portfolio volatility between market timing and buy-and-hold strategies reveals stark contrasts in risk exposure and recovery trajectories during market turbulence.

While market timing attempts to circumvent downside volatility through tactical repositioning, the strategy’s effectiveness becomes compromised by the statistical probability of missing vital recovery periods that historically cluster near market bottoms. Research has consistently shown that long-term holding produces more reliable returns, with no negative results observed in any 20-year period from 1926 to 2011.

Dollar-cost averaging provides a disciplined middle-ground approach that helps investors avoid the psychological pitfalls of market timing while maintaining consistent exposure to market opportunities.

The compounded effect of missed opportunities, particularly evident in the potential 50% reduction in returns from missing just the top 10 trading days over two decades, demonstrates the inherent vulnerability of timing-based approaches compared to systematic buy-and-hold methodologies.

Portfolio Volatility Comparison

Investment strategists rigorously analyze the distinct volatility profiles exhibited by market timing and buy-and-hold approaches when evaluating portfolio risk dynamics.

The effectiveness of volatility measurement reveals critical differences between these strategies, with market timing potentially reducing exposure during turbulent periods while introducing execution risks. Investors must commit to extensive daily monitoring when pursuing active market timing strategies.

Market timing strategies demonstrate lower portfolio volatility when executed precisely, allowing investors to sidestep significant market downturns. However, the approach requires sophisticated timing signals and incurs higher transaction costs that can impact overall performance. Maintaining risk-reward ratios for each trade is essential for sustainable market timing success.

Buy-and-hold portfolios experience full market cycles, including both drawdowns and recoveries, typically resulting in higher short-term volatility but more predictable long-term patterns.

This passive approach eliminates timing risk while minimizing operational complexity and trading costs, though investors must weather complete market fluctuations without protective positioning.

Long-Term Risk Exposure

Long-term risk exposure presents a fundamental distinction between market timing and buy-and-hold strategies, extending well beyond the immediate volatility considerations that shape day-to-day portfolio management.

Buy-and-hold investors weather full market drawdown duration but historically benefit from the natural recovery timeline of markets, while market timers face heightened risks from mistimed exits and entries.

Research demonstrates that missing just the top 10 trading days over two decades can reduce returns by more than 50%, markedly amplifying long-term portfolio risk. Empirical evidence reveals that attempting to time the market results in returns similar to cash-like investments when missing even 12 best months.

The compounding effect of diversification benefits buy-and-hold strategies, whereas market timing can inadvertently concentrate risk through excessive cash positions or single-asset exposure.

Furthermore, behavioral biases inherent in market timing decisions frequently lead to suboptimal trade execution, potentially resulting in permanent capital impairment.

During periods of interest rate volatility, market timing strategies become particularly vulnerable to miscalculation as rate fluctuations affect both fixed income and equity valuations simultaneously.

Market Loss Recovery Rates

Three essential factors distinguish market loss recovery rates between timing and buy-and-hold approaches, with the latter demonstrating superior resilience during market rebounds and economic recoveries.

Historical data reveals that missing just the top 10 trading days in the Dow Jones Industrial Average resulted in approximately 10,000 lost points, notably impeding portfolio recovery trajectories. Transaction costs and frequent trading fees can further erode potential returns when attempting market timing strategies.

Consumer confidence indices serve as leading indicators that can signal market directional shifts, though attempting to time these movements remains challenging. Investment strategies focused on market timing expose investors to heightened risks of missing vital recovery periods, particularly during volatile rebounds when emotional decision-making can lead to mistimed exits and entries.

Analysis of market recovery patterns indicates that buy-and-hold investors benefit from full participation in all upward movements, while timing attempts have resulted in a documented 32-basis point annual performance gap according to Morningstar’s research on UK investors’ behavioral patterns.

Time Investment and Management Requirements

While both market timing and buy-and-hold strategies demand varying levels of attention from investors, the disparity in time commitment and management intensity between these approaches proves substantial and consequential.

Market timing requires extensive daily engagement, necessitating continuous market monitoring, rapid response to economic developments, and frequent technical analysis, which often leads to decision fatigue among practitioners. The strategy demands sophisticated analytical tools, real-time data feeds, and advanced financial knowledge, creating a significant operational burden. Studies show that even with intensive monitoring, attempting to time the market only yields about $500 extra annually compared to simpler strategies. Successful implementation relies heavily on understanding chart patterns and multiple timeframe analysis to identify optimal entry points.

Market timing demands constant vigilance and sophisticated tools, burdening investors with endless analysis and the exhausting weight of perpetual decision-making.

In contrast, buy-and-hold investing operates with minimal oversight requirements, typically involving annual portfolio rebalancing and periodic performance reviews. This approach enables automated investment processes and reduces cognitive load through straightforward asset allocation decisions.

The resource implications extend beyond time investment, as market timing necessitates costly subscriptions to analysis platforms and higher transaction fees, while buy-and-hold strategies maintain lower ongoing expenses and simplified management requirements.

Geographic Variations and Market Differences

Empirical analysis reveals distinct geographic variations in the effectiveness of market timing versus buy-and-hold strategies across major financial markets worldwide.

The U.S. market demonstrates superior returns for buy-and-hold approaches, with the S&P 500 yielding 9.10% average annual returns over the past decade, while UK investors experience particularly smaller timing-related performance gaps compared to other developed markets. Recent evidence shows investors who attempted timing strategies lost one-sixth of returns through poorly timed trades. Moving average crossovers remain one of the most widely used technical indicators for market timing across global exchanges.

Cross-market examination indicates that structural factors, including market liquidity and regulatory frameworks, greatly influence the relative success of timing strategies, with emerging markets presenting heightened challenges due to reduced liquidity and increased transaction costs.

Regional Performance Patterns

Global equity markets exhibit distinct regional performance patterns that reflect varying economic conditions, policy environments, and market dynamics across major geographic zones.

The pronounced regional return divergence demonstrates U.S. equity markets‘ continued dominance, supported by technological innovation and robust capital spending.

Analysis of sector performance reveals stark contrasts, with U.S. markets benefiting from AI-driven technology growth while European markets face structural impediments. Strategic sector rotation strategies can help investors capitalize on these regional differences by adjusting allocations based on economic cycles.

Japanese equities demonstrate renewed strength through domestic reforms and favorable currency conditions, while emerging markets struggle against dollar strength and trade headwinds.

Factor performance varies greatly by region, with UK markets showing strong momentum in large-cap stocks, while U.S. markets benefit from both growth and value contributions. The potential Federal Reserve rate cuts later this year could further reshape regional performance dynamics.

This regional disparity underscores the importance of geographic diversification in portfolio management.

Cross-Market Timing Effectiveness

Despite common market timing approaches, the effectiveness of cross-market timing strategies exhibits substantial variation across different geographic regions and market structures.

Developed markets demonstrate superior timing effectiveness due to their robust price signals and efficient information dissemination.

Cross market strategies yield more consistent results in mature economies where market microstructure and regulatory frameworks support sophisticated execution.

The effectiveness of timing across emerging markets faces significant challenges due to heightened volatility, irregular capital flows, and reduced liquidity profiles.

Volume price divergence analysis provides crucial insights for identifying market reversals and trend confirmation across different geographical regions.

Timing effectiveness particularly diverges in long-term debt instruments, where developed markets show greater predictability in corporate security issuance patterns.

Market structure differences, including trading hours and regulatory requirements, create exploitable opportunities while simultaneously introducing execution complexities that demand precise calibration of cross-market timing approaches.

Advanced statistical methods utilizing regime-switching models enable more accurate identification of market patterns across different geographic regions.

UK Vs Global Results

While the United Kingdom exhibits the smallest market timing losses among major global markets, with investors surrendering only 32 basis points of annualized returns due to timing errors, other regions demonstrate considerably larger performance gaps that frequently exceed double the UK’s shortfall. This superior UK performance stems from historically less reactive investor behavior during market volatility and robust regulatory frameworks. Financial advice frameworks that emphasize total portfolio management rather than individual fund performance have contributed significantly to the UK’s better timing outcomes.

| Market Region | Buy-and-Hold Return | Timing Return | Performance Gap |

|---|---|---|---|

| UK | 4.46% | 4.14% | -0.32% |

| US | 5.20% | 4.40% | -0.80% |

| Europe | 4.80% | 3.90% | -0.90% |

| Asia | 4.90% | 3.85% | -1.05% |

Global performance data reveals that market timing effectiveness varies considerably across regions, with emerging markets experiencing particularly pronounced negative impacts from timing decisions due to heightened volatility and less sophisticated market structures.

Long-Term Wealth Building Outcomes

Success in long-term wealth accumulation demonstrates a clear divergence between market timing and buy-and-hold strategies, with historical data strongly favoring the latter approach. The evidence spans over six decades, revealing that consistent market participation through buy-and-hold methodologies delivers superior returns compared to timing-based approaches.

Analysis of S&P 500 performance indicates that investors pursuing financial independence through buy-and-hold strategies have achieved approximately 9.1% annual returns over the past decade. This wealth accumulation advantage becomes particularly pronounced when considering that market timing attempts frequently result in missing the handful of vital trading days that generate the majority of annual gains.

Market timing risks missing crucial trading days, while buy-and-hold strategies have consistently delivered strong returns averaging 9.1% annually in the S&P 500.

The data reveals that timing errors have cost UK investors 32 basis points in annualized returns, while buy-and-hold investors have historically captured fuller market returns through reduced trading frequency and emotional decision-making. Well-diversified allocation funds demonstrate lower return gaps and reduced volatility compared to other investment options, further supporting the buy-and-hold approach.

This performance gap underscores the significant advantage of maintaining consistent market exposure for long-term portfolio growth.

Frequently Asked Questions

How Do Dividends Impact Returns in Market Timing Versus Buy-And-Hold Strategies?

Dividend reinvestment greatly impacts return comparison between market timing and buy-and-hold strategies.

Research demonstrates that buy-and-hold investors capture approximately 40% of total returns through consistent dividend reinvestment and compounding benefits.

In contrast, market timing strategies often forfeit dividend income during out-of-market periods and incur higher transaction costs from frequent trading.

The compounding effect of reinvested dividends typically enables buy-and-hold portfolios to outperform market timing approaches over extended periods.

What Role Do Market Indicators and Technical Analysis Play in Timing Decisions?

Market indicators and technical analysis serve as foundational tools for executing timing decisions in trading.

Professional traders leverage multiple indicators including moving averages, RSI, and MACD to generate trading signals and identify potential market entry/exit points.

While these analytical methods provide structured frameworks for decision-making, their effectiveness depends heavily on proper interpretation and integration with other market factors.

Technical analysis complements fundamental research but requires sophisticated understanding to avoid false signals and timing errors.

How Do Tax Implications Differ Between Market Timing and Buy-And-Hold Approaches?

The tax implications differ considerably between trading strategies through their impact on capital gains treatment and tax bracket optimization:

- Market timing typically generates frequent short-term gains taxed at higher ordinary income rates, creating ongoing tax liabilities that reduce compounding potential.

- Buy-and-hold strategies benefit from preferential long-term capital gains rates and tax deferral, allowing more wealth to remain invested and compound over time.

- The complexity of tax management increases greatly with frequent trading compared to strategic long-term holding periods.

Can Automated Trading Systems Improve Market Timing Success Rates Significantly?

Like a master chess player anticipating moves, automated algorithms have revolutionized market timing success rates.

Research indicates these systems achieve win rates 15-20% higher than human traders by eliminating trading psychology biases and executing strategies with microsecond precision.

Through advanced machine learning techniques and real-time pattern recognition, automated systems can identify and capitalize on market inefficiencies far more consistently than traditional discretionary approaches, while maintaining disciplined risk management protocols.

How Do Different Economic Cycles Affect the Effectiveness of Each Strategy?

The effectiveness of investment strategies fluctuates considerably across economic cycles.

During economic expansion periods, buy-and-hold typically excels as steady market growth compounds returns.

However, during recession phases marked by declining consumer confidence and heightened market volatility, tactical timing approaches may offer defensive advantages.

Interest rates and inflation impact both strategies differently – rising rates tend to favor more active management, while stable rate environments generally benefit long-term holding.

Market conditions ultimately dictate each strategy’s relative performance through varying cycles.

Conclusion

While market timing may occasionally yield favorable short-term results, historical data consistently demonstrates that buy-and-hold strategies generate superior long-term returns for most investors. Like attempting to catch falling knives, timing the market’s peaks and troughs proves perilously difficult even for seasoned professionals. The evidence suggests that patient capital allocation, diversification, and time in the market—rather than timing the market—remain the most reliable paths to sustainable wealth accumulation.

References

- https://www.dividend.com/dividend-education/market-timing-the-best-and-worst-sp-500-trading-days/

- https://www.aqr.com/Insights/Perspectives/So-What-If-You-Miss-the-Markets-N-Best-Days

- https://www.vectorvest.com/blog/market-timing/buy-and-hold-vs-timing-the-market/

- https://www.finra.org/investors/insights/market-timing

- https://www.morningstar.co.uk/uk/news/240490/buy-and-hold-or-time-the-market-mind-the-gap!.aspx

- https://www.investopedia.com/articles/stocks/08/passive-active-investing.asp

- https://www.visualcapitalist.com/chart-timing-the-market/

- https://exsys.iocspublisher.org/index.php/JMAS/article/view/379

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5265809

- https://snowpinewealth.com/understanding-behavioral-biases-in-investment-decision-making-a-guide/